car lease tax deduction calculator

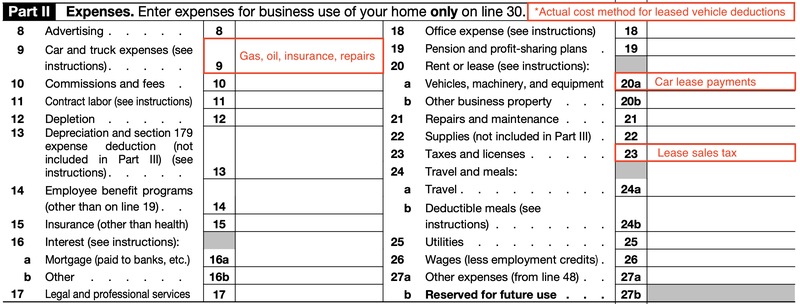

Actual Expenses - To use the actual expense method you must determine what it actually costs to operate the car for the portion of the overall use of the car thats business useInclude gas oil repairs tires insurance registration fees. See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only.

How To Deduct Car Lease Payments In Canada

It pays to learn the nuances of mileage deductions buying versus leasing and depreciation of vehicles.

. Self-Employed defined as a return with a Schedule CC-EZ tax form. If you bought it a few years ago you can even write off a portion of the cars original cost. Use this link to the Revenue Departments Washington car tax calculator where you can plug in your Washington address.

If you use vehicles in your small business how and when you deduct for the business use of those vehicles can have significant tax implications. Edmunds True Cost to Own TCO takes depreciation. Loan interest taxes fees fuel maintenance and repairs into.

Not ALL STATES offer a tax and tags calculator. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon. The only additional expenses allowed with standard miles are below.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. You may deduct car washes if you take actual expenses. Choose the method with the highest deduction.

Add up all the costs associated with your leased car. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Learn How to Get the Biggest Car Tax Deduction When you buy a car from an auto dealer the amount of tax you pay is automatically calculated for both state and county tax and included in the overall sticker price.

Special rules for business vehicles can deliver healthy tax savings. Weve partnered with Naked to help you get your car covered against theft accidents and Mother Nature. This is known as the State And Local Tax SALT deduction which also allows for real estate taxes property taxes and other sales taxes write offs.

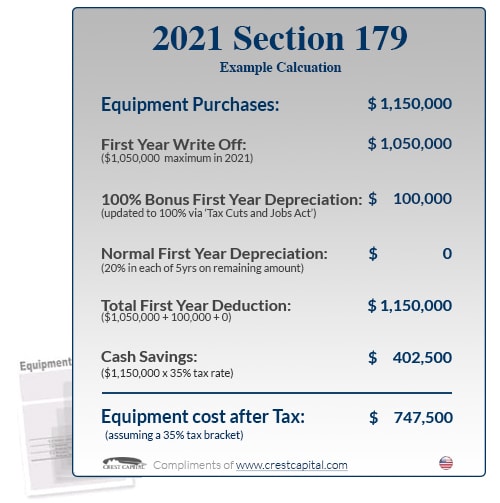

You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179. Monthly leasing payments satisfy a long-term rental contract while monthly financing loan payments go toward eventual ownership. How you work out your deduction will depend on if you are using.

In Beckys case shed go for the standard mileage rate deduction because the. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Americas 1 tax preparation provider.

Leasing contracts are typically shorter than loan terms and leasing payments are. Beckys actual expense method deduction comes out to 8175. You may be able to claim a deduction for motor vehicle expenses if you use the vehicle in performing your work-related duties.

A motor vehicle that is not defined as a car. If you are on the hunt for a new car you may be weighing the lease-vs-finance questionThe primary difference is essentially renting versus buying. Exceptions also apply for art collectibles and.

Your estimated IRS mileage deduction is 34500 over the course of your lease. Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. Cost of the car.

This free Auto Lease Calculator allows you to determine your monthly auto lease payments and provides you with an effective method to estimate what your total lease payments will be as well as your net capitalized costs lease fees depreciation and residual asset value. Lease payments insurance costs. Yes No Did you keep any records of vehicle-related expenses.

These expenses replace the mileage-based deduction you take with the standard mileage method. Travel Deduction Tax Calculator for 2022 Compare Actual Costs and Deemed Costs for the Maximum Tax Deduction. Anytime you are shopping around for a new vehicle and are beginning to make a budget its.

If you finance your car then you can write off your own car payments. This stipulation can reduce your tax bill more significantly than if you were to depreciate your assets over a. 1 online tax filing solution for self-employed.

Do you hire lease this vehicle. Calculate the cost of owning a car new or used vehicle over the next 5 years. Tally your car lease costs.

This is called. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. A car your own lease or hire under a hire-purchase arrangement someone elses car.

Lease Vs Buy Calculator For Auto Land Or Other Assets

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

How To Write Off A Car Lease For Your Business In 2022

Is Your Car Lease A Tax Write Off A Guide For Freelancers

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Dmv Fees By State Usa Manual Car Registration Calculator

Section 179 Tax Deduction Vehicles List Bell Ford

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Writing Off A Car Ultimate Guide To Vehicle Expenses

How To Lease A Car When You Can T Afford To Buy One Buy Vs Lease Calculator Quote Com

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values