do nonprofits pay taxes on investment income

Your nonprofit probably wont have to pay federal income tax or state income taxes as long as youve applied for tax-exempt status with the IRS and presented the letter of. For tax years beginning after Dec.

Nonprofit Income Streams An Introduction Nonprofit Accounting Academy

And since 501 c 3.

. There is a minimum penalty of 100 and a maximum of 2500 for. You use Form 990-T for your tax return. A nonprofit that uses the.

If the organization has to file an NPO information return and fails to do so on time the basic penalty is 25 per day late. Most nonprofits fall into this category and enjoy numerous tax benefits. For tax years beginning on or before Dec.

First and foremost they arent required to pay federal income taxes. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and. While the accrued earnings of the endowment are usually tax-free payouts may be taxable depending on the recipient.

While the IRS usually excludes investment income from a nonprofits taxed unrelated business income it will usually tax investment income from for-profit subsidiaries or. For example if your nonprofit. Most nonprofits do not have to pay federal or state income taxes.

In most cases they wont owe income taxes at the. Do nonprofit organizations have to pay taxes. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

For example an operating endowment that funds non. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598. 435 15 votes.

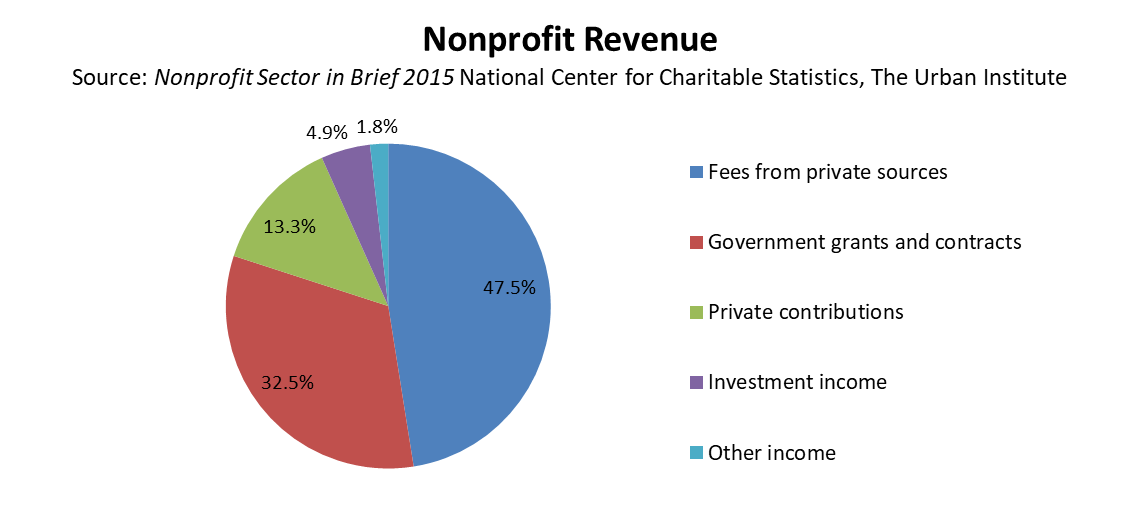

Do nonprofits pay income tax on investments. Any nonprofit that hires employees will also. Excluding foundations one in five nonprofits receives.

That said youll want to check your local rules in case they. As a result the IRS does not impose income tax when a stock investment pays dividends or when it sells the stock for more than it purchased it for. Do nonprofits pay taxes on investment income Tuesday April 19 2022 That means any unused money at the end of the period gets taxed as well.

Investment income consisting of interest dividends and capital gains is very important to a small group of nonprofits. However here are some factors to consider when. An agricultural organization a board of trade or a chamber of commerce as described.

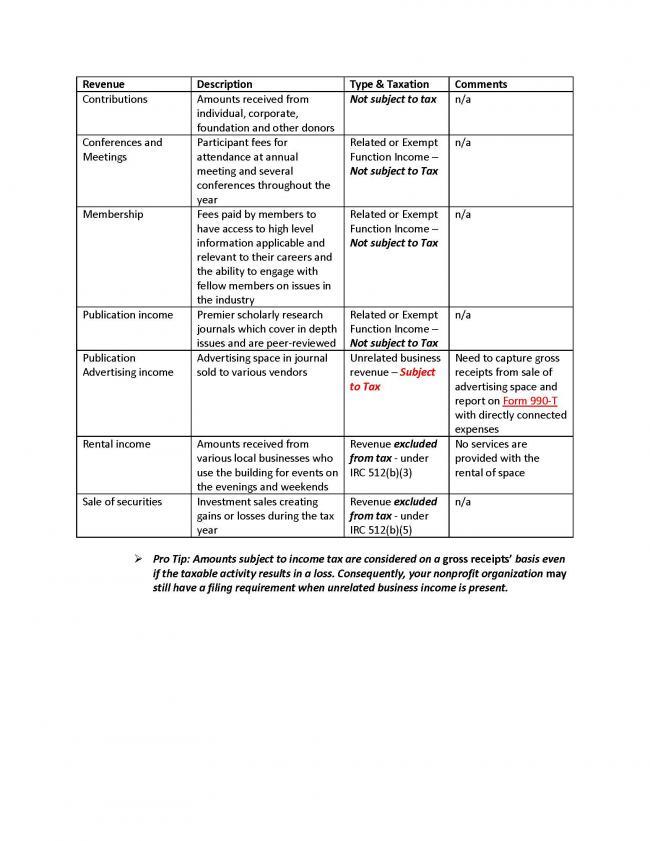

Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it under. Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for.

While it is true that under most circumstances tax-exempt organizations are not subject to a corporate level income tax as their taxable entity counterparts are required to.

Business Nonprofit Fundraising Ideas Capital Gains Tax Capital Gain Tax Credits

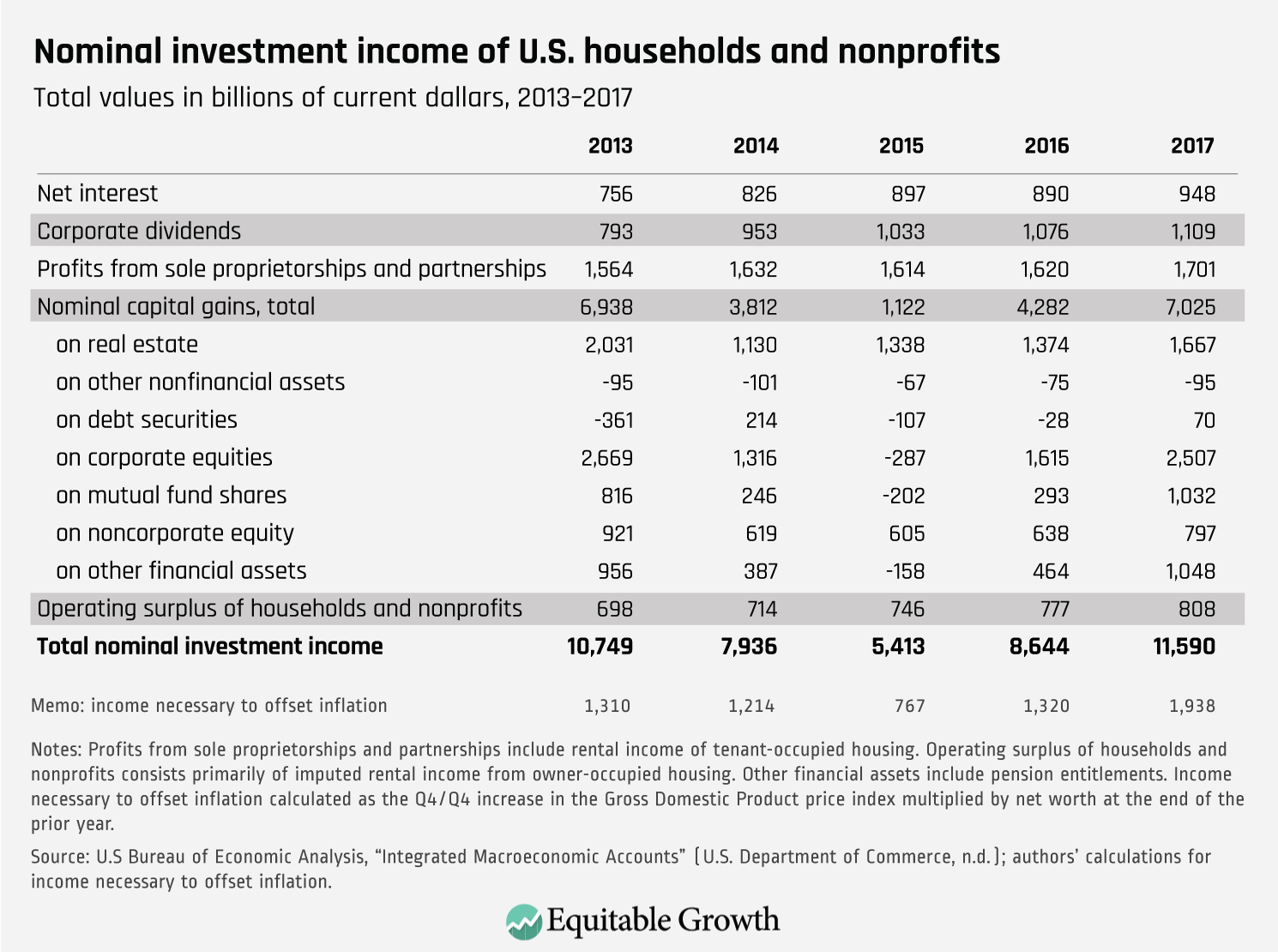

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S F Income Tax Tax Preparation Income Tax Preparation

With Limited Resources Nonprofit Financial Data Is Key

Do Nonprofit Organizations Need To Pay Taxes Boardeffect

When Does Your Nonprofit Owe Ubit On Investment Income Tonneson Co

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Why Should Nonprofits Consider Using An Operating Measure

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Cooperative Economics Worker Cooperation

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Why Should Nonprofits Consider Using An Operating Measure

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

A Guide To Investing For Non Profit Organizations Round Table Wealth

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)